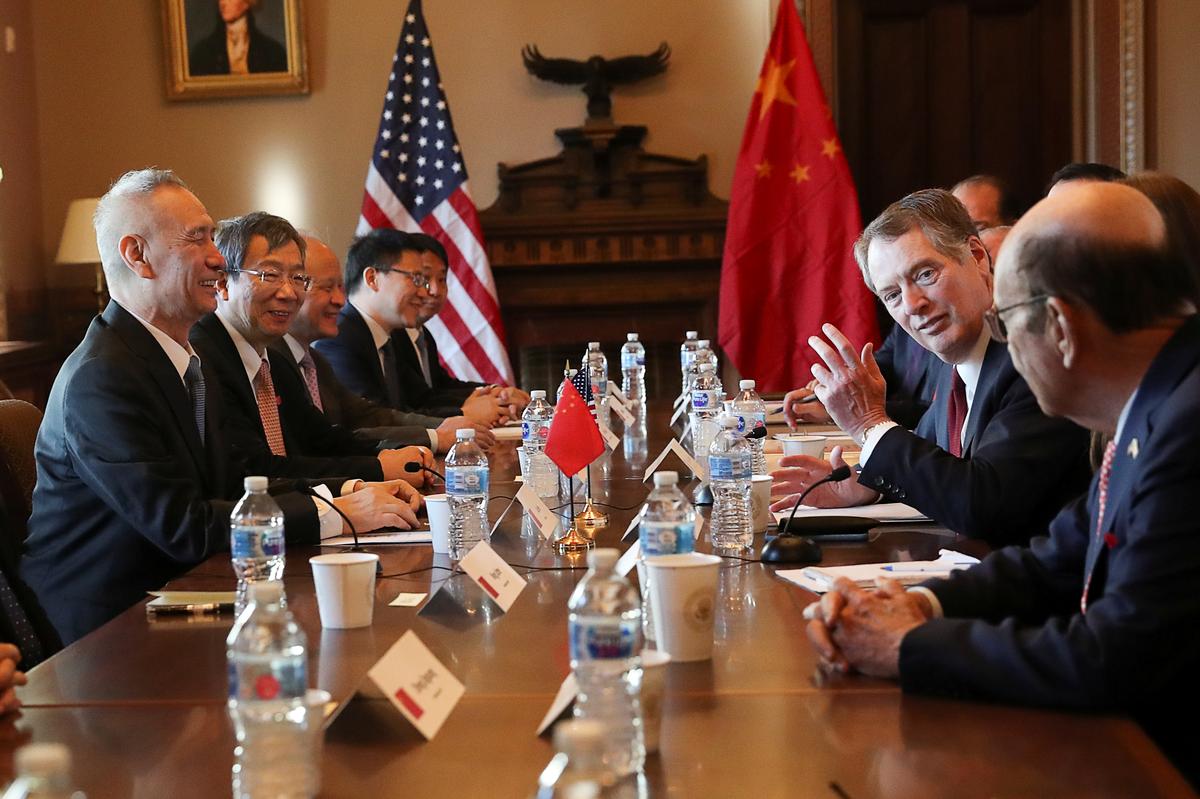

US stock futures swung higher on Monday, as President Donald Trump said China wants to “get back to the table” and re-negotiate an agreement, signaling a potential de-escalation in an increasingly complex trade dispute.

“China called last night", "and said ‘let’s get back to the table’, so we will be getting back to the table and I think they want to do something. They have been hurt very badly but they understand this is the right thing to do and I have great respect for it. This is a very positive development for the world”, Trump said on the sidelines of the Group of 7 meeting in Biarritz, France.

The President later wrote in a tweet that he has “great respect for the fact that President Xi & his Representatives want a ‘calm resolution’”.

This morning’s move follows a sharp Friday sell-off, where tensions between the US and China reached new heights amid Donald Trump’s demand that American companies seek “an alternative” to China in response to Beijing’s latest volley of tariffs.

Beijing announced that it would apply additional levies of between 5% to 10% on $75 billion of US imports from September, marking the latest escalation in the tit-for-tat trade war between the two countries.

The S&P 500’s initial reaction to the escalation saw the benchmark post its third-worst day of the year with a drop of -2.57%. The sell-off pressured Wall Street into its fourth consecutive week of losses.

Shares across Retail (-3.79%) and Technology (-3.31%) sectors

suffered some of their heaviest losses of 2019. The Nasdaq Composite shed -3.16% off its value.

Ahead, in today’s economic calendar, Monday includes; Durable Goods Orders for July at 8:30am EST.

TODAY'S TOP HEADLINES

China & Trade: Trump Says China Called The US to "Get Back To The Table" After Latest Tariff Spat. (Bloomberg)

President Trump said China called US officials on Sunday evening and said “let’s get back to the table,” a day after the White House said the president regretted not escalating tariffs further on Chinese goods.

ECONOMIC CALENDAR

Today's Economical Announcements.

08:30AM - ★★★ - C. Durable Goods (MoM) (Jul) (Previous: 1%)

STOCKS IN THE SPOTLIGHT

Pre-Market Movers & News Related Stocks.

Dish Network (DISH): [UPGRADE] Upgraded to “strong buy” from “market perform” at Raymond James, which sees upside for the satellite TV operator on multiple fronts involving both its pay-TV and wireless operations.

Celgene (CELG): [NEWS] Agreed to sell the rights to its Otezla psoriasis drug to Amgen for $13.4 billion in cash. Bristol-Myers Squibb had previously agreed to the Otezla divestiture to win approval for its pending merger with Celgene.

PDC Energy (PDCE): [MERGER] Is combining with fellow energy producer SRC Energy (SRCI) in an all-stock transaction valued at about $1.7 billion.

Lyft (LYFT): [UPGRADE] Upgraded to “buy” from “neutral” at Guggenheim Securities, citing several factors including rising fares.

Cree (CREE): [DPWNGRADE] Downgraded to “underweight” from “neutral” at Piper Jaffray, following the lighting products maker’s last quarterly results and weaker than expected outlook. The firm also cut its price target for the stock to $38 per share from $57.

Tesla (TSLA): [NEWS] Is planning to raise prices in China this week according to a Reuters report. That would be earlier than originally planned. The electric automaker is said to be considering another increase in December if Chinese tariffs on U.S.-made cars take effect.

Walt Disney (DIS): [NEWS] Will launch stores inside 25 Target locations in October, and plans to launch 40 more of the “stores within a store” by October 2020. The first locations will be in major cities including Philadelphia, Denver, and Chicago.

Mallinckrodt (MNK): [NEWS] Is under scrutiny for its role in the opioid crisis, according to a Wall Street Journal report. The paper notes that the bulk of the attention surrounding opioids has focused on OxyContin maker Purdue Pharma, but that other drug makers like Mallinckrodt are drawing more focus as more legal documents become public.

Raytheon (RTN): [NEWS] Won a $534 million Army contract for infrared viewers used by military tanks to select targets.

Foot Locker (FL): [DOWNGRADE} Susquehanna Financial downgraded the athletic footwear and apparel retailer’s stock to “neutral” from “positive”, noting disappointing second quarter results and saying that Foot Locker’s outlook is still too optimistic.

MOMENTUM STOCKS

GAINERS: -

DECLINERS: FL, SLCA, VMW, HAS, PUMP, MSGN

TODAY'S IPOs

None.