Stocks:

Despite the short trading month, we had some interesting reports, including Wix, Fiverr, Baidu, and Moderna. The most notable move came from Nvidia, which jumped nearly 15% in a single trading day after publishing its profit reports for the last quarter. Although the company was weakened in the gaming and chips sector due to the decline in the market, it continues to excel in its data center division, which shows investors that the company is not reliant on one field and is a significant player in the tech world.

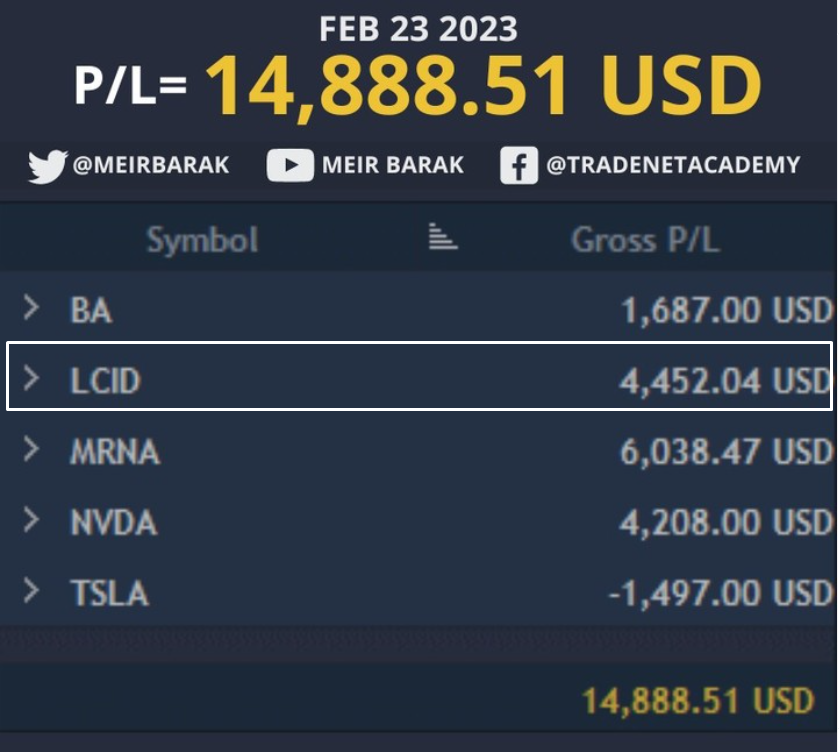

One of the most fulfilling moments in the trading room was when we entered into a short trade on Lucid stock (LCID). We traded the entire time using only level 2, and at the end of the trading session, we explained in detail the depth of level 2, the quantities of buyers and sellers in the decision-making process.

Another fascinating day in the trading room was when we decided to short the AI stock. Due of the buzz of artificial intelligence and ChatGPT that have entered our lives, traders are uncovering opportunities to profit from it. The AI stock, that is not related much to ChatGPT itself, enjoyed tremendous demand and jumped 100% in just two weeks!

In most cases, trends tend to disappear quickly, so we decided to short the AI stock, understanding that the sharp rise of the stock came from the buzz in its symbol. A few minutes after the market opening, we shorted the stock to enjoy the down move.

Cryptocurrency:

February had been off to a great start as FOMC chair, Jay Powell, sent all markets higher with an unexpected dovish tone in his live Q&A on the 1st of February. While equities continued higher, we got caught out on our Ethereum (ETH/USD) long, anticipating a follow-through on the breakout on the next trading day. Cryptocurrencies found it difficult and rejected the break higher, before selling down amidst news of Paxos declining to issue more of Binance’s stablecoin (BUSD).

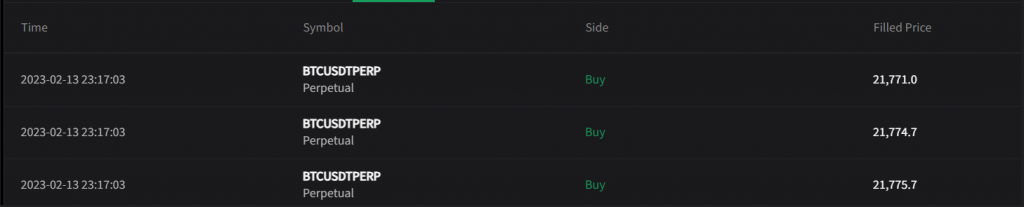

At that point, we had to reassess and adjust to be able to profit from our trades, which we did with multiple longs and shorts. Bitcoin (BTC/USD) and Solana (SOL/USD) provided most of the opportunities during this month, as they had a very good technical compliance for the strategies. Our best trades came in the form of longs as Bitcoin and Solana broke out of consolidation above 22k and 21.50 to make new highs for 2023 at 25.2k and 27.12, respectively.

The market’s resilience may have been supported by news of consultation papers around crypto regulations issued in both the US and UK. Additionally, the positive whispers about Elon Musk’s Twitter possibly incorporating crypto payments and Binance’s partnership with Mastercard in Brazil lifted the tone in the sector.

The break higher didn’t last long though as most cryptocurrencies found a new resistance, especially BTC around the 25k psychological level. With that in mind, we were able to capitalize on a failed break higher with a few shorts, as the price fell back into the 23k area.